Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

21 July 2023,05:49

Daily Market Analysis

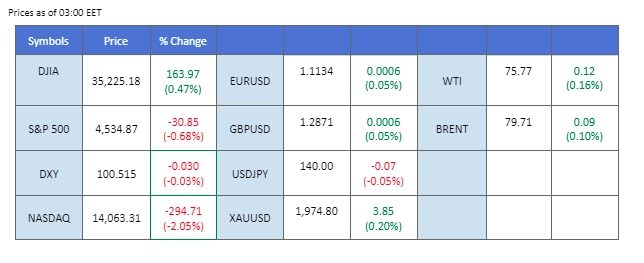

Asian equity markets faced declines, influenced by the U.S. equity market’s disappointing earnings results. Last night, Nasdaq experienced a substantial drop of over 2%, marking its most significant single-day decline since March. Conversely, the U.S. dollar displayed strength, surging more than 0.5% yesterday. This surge was triggered by optimistic job data in the U.S., which led the market to speculate on the possibility of further rate hikes by the Federal Reserve after the July rate hike. In another development, Japan’s core Consumer Price Index (CPI) rose by 0.1% to reach 3.3%. With the country’s CPI consistently staying above 3% since last October, the market has begun to speculate that the ultra-loose monetary policy implemented by the Japanese authorities may be approaching its conclusion.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (0.2%) VS 25 bps (99.8%)

The Dollar Index skyrocketed against major currencies as the latest US job data surprised investors. New claims for unemployment benefits dropped by 9,000 to 228,000, beating market expectations of 242,000 claims. This unexpected decline fueled optimism about the economic progress in the United States, strengthening the greenback.

The dollar index is higher while currently near the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 40, suggesting the index might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 101.45, 104.25

Support level: 98,70, 94.75

Gold prices pulled back from higher levels as the Dollar gained strength following positive US Initial Jobless Claims data. Furthermore, market participants’ expectations of a 25 basis point rate hike during the upcoming FOMC monetary decision in July weighed on gold prices.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 55 suggesting the commodity might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 1985.00, 2000.00

Support level: 1970.00, 1950.00

Last night, the euro broke out of its week-long price consolidation range and is now trading below the 1.1200 level. The optimistic U.S. job data primarily drove the decline in the euro’s value. The U.S. initial jobless claims unexpectedly dropped to 224,000, surpassing market expectations and showing improvement from the previous reading of 237,000. This indicates that the labour market in the U.S. remains tight, which poses a challenge for the Federal Reserve in its efforts to combat inflation. The positive job data, combined with the consistent hawkish statements from the Federal Reserve, has bolstered the U.S. dollar, leading it to gain strength against other major currencies.

EUR/USD has dropped out of the price consolidation range signalling for a trend reversal. The RSI has declined to near the oversold zone while the MACD is crossing below the zero line suggesting the bullish momentum has vanished.

Resistance level: 1.1338, 1.1410

Support level: 1.1157, 1.1088

The Pound Sterling extended its downward trend as the U.K.’s Consumer Price Index (CPI) unexpectedly dropped to 7.9%, fueling market speculation of a more dovish approach from the Bank of England (BoE). Additionally, the declining U.K. 2-year bond yield further weighed on Sterling’s performance. On the other hand, the U.S. dollar saw a slight increase in value following the release of the initial jobless claims data, indicating that the U.S. labour market remains tight. This positive data will likely encourage the Federal Reserve to continue its monetary tightening policy.

GBP/USD is trading lower and has dropped for 5 consecutive sessions, suggesting that the cable is trading with strong bearish momentum. The RSI has dropped to the oversold zone while the MACD has crossed below the zero line, depicting a bearish signal for the cable as well.

Resistance level: 1.2940, 1.3012

Support level: 1.2840, 1.2750

The Nasdaq suffered significant losses, primarily influenced by disappointing financial results from major tech players like Tesla and Netflix. Tesla’s shares plummeted 9.74% due to a drop in second-quarter gross margins, marking its most substantial one-day percentage decline since April 20. Netflix also slumped 8.41% as its quarter revenue missed estimates, leading to its most significant one-day percentage drop since December 15.

Nasdaq is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 54, suggesting the index might extend its losses toward support level since the RSI retreated sharply from overbought territory.

Resistance level: 14370.00, 14840.00

Support level: 13875.00, 13195.00

The Japanese yen faced selling pressure as consumer inflation in Japan increased by 3.30% in June, falling short of the projected 3.50% growth. This softer inflationary trend eases pressure on the Bank of Japan (BoJ) to take immediate tightening measures, causing the yen to experience a bearish slide.

USD/JPY is trading higher while currently near the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 57, suggesting the pair to be traded lower as technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 140.50, 142.10

Support level: 139.20, 137.65

Lack of market catalysts kept the overall trend in the oil market flat. Nevertheless, China’s record-high imports of crude oil from Russia in June signalled resilient demand in the country despite its economic recovery falling short of expectations. Additionally, expectations of ongoing OPEC+ production cuts provided support to oil prices. Investors are closely watching further economic developments and OPEC+ policies for trading signals.

Oil prices are trading flat while currently near the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 54, suggesting the commodity might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 77.30, 79.75

Support level: 73.70, 70.30

Trade with simulated capital and earn real profits after you pass our trader assessment.

20 May 2025, 06:46 Gold Slips as Ceasefire Hopes Curb Safe-Haven Demand

7 May 2025, 03:59 Geopolitical Risks and FOMC Uncertainty Shake Global Markets

6 May 2025, 05:53 Dollar Dips, Gold Rallies on U.S.-Taiwan Risk

New Registrations Unavailable

We’re not accepting new registrations at the moment.

While new sign ups are unavailable, existing users can continue their challenges and trading activities as usual.