Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

Content:

In the dynamic world of finance, where global currencies constantly fluctuate, gaining proficiency in forex trading is an invaluable skill. This article delves into the fundamental forex trading basics, providing a clear and concise understanding of the mechanisms behind this intricate market. Whether you’re a novice or an experienced trader, this guide will equip you with the essential knowledge to navigate the intricate realm of forex trading with confidence.

The Foreign Exchange, commonly known as forex or shortened to FX, is the global marketplace where international currencies and their derivatives are traded. It is the largest financial market in the world in terms of both size and liquidity.

To give a general idea of the market size, close to US$ 7 trillion in currencies is traded globally every day, with the currency market being the largest and most liquid market in the entire globe.

The basic idea of forex is the exchange of one country’s currency for the currency of another country. With forex, you’re essentially buying one currency and selling the other at the same time. As a result, forex trades always happen in pairs.

For example, the British Pound-US Dollar pair (GBP/USD) refers to the amount of USD one gets for each GBP.

Due to the higher stability and liquidity of certain currencies, some forex pairs are more popular than others. These include the Euro vs. US Dollar (EUR/USD); British Pound vs. US Dollar (GBP/USD); US Dollar vs. Japanese yen (USD/JPY); and US Dollar vs. Swiss Franc (USD/CHF). These four pairs are often referred to as the major currency pairs.

Unlike the stock exchange, the Foreign Exchange market is decentralised. It has no set physical location. This makes forex an OTC (Over-the-Counter) market, where trades happen directly between two parties without a centralised exchange.

Because of this, forex trading can happen anywhere in the world. Forex hubs exist in various time zones, made up of an electronic network of banks, brokerages, institutional investors, and individual traders – this allows forex trading to happen 24 hours a day, 5 days a week.

The forex market is open 5 days a week and only closes at weekends between 22:00 (GMT) on Friday and 22:00 (GMT) on Sunday. While the forex market is open 24 hours a day, there are some peak trading session times in each region. We have a general outline below:

Want To Know More About Our Forex Products?

In forex, currencies are always traded in pairs. This is because one currency is valued against another by an exchange rate. An exchange rate is how much you’d have to pay in a quote currency, to get 1 unit of a base currency.

The quote currency, sometimes referred to as the counter currency, is the second currency in both direct and indirect currency pairs and is used to calculate the value of the base currency in foreign exchange (FX).

In Forex Trading, a quote is usually displayed like the following:

EUR/USD = 1.1200

This means that 1 € = 1.12 $

The Euro, written as EUR, is known as the Base Currency.

The US Dollar, written as USD, is known as the Counter or Quote Currency.

When the US Dollar is the Base Currency, it is often referred to as a Direct Quote in the context of trading.

For example:

USD/JPY = 125.00

This means 1 $ = 125 ¥

The US Dollar, written as USD, is known as the Base Currency.

The Japanese Yen, written as JPY, is known as the Counter or Quote Currency.

When the US Dollar is the base currency, it is referred to as an Indirect Quote.

When trading Forex, there are several unique terms used. A Pip and Lot are two of the most basic terms used in forex.

In Forex trading, the price of a currency pair moves up and down in very tiny increments and the unit of measurement to express the extent of these movements is known as Pips, an acronym for “percentage in point”.

It is the smallest possible increment in a quote and usually the last decimal place in a quotation. Most currency pairs will have a pip equivalent to 0.0001, with the Japanese Yen being one of the major exceptions at 0.01.

For instance, if the exchange rate of GBP/USD goes up from 1.5696 to 1.5697, we can say that the price of GBP has gone up by 1 pip. On the other hand, if the exchange rate of USD/JPY goes down from 115.75 to 115.74, we can say that the rate has gone down by 1 pip.

In more recent times, some brokers have also started offering what is known as a pipette, or point, which is 1/10 the value of a pip. This allows customers more flexibility with their trades.

Forex is also commonly traded in specific amounts called lots. A standard “lot” is 100,000 units of the base currency. In the case of EUR/USD, one lot is EUR 100,000.

As mentioned previously, a pip refers to 0.0001 of a quote currency. Therefore, one pip of a standard lot equals 10 units of the quote currency. In the case of EUR/USD, a movement of 1 pip would mean a loss/profit of $10 per lot traded.

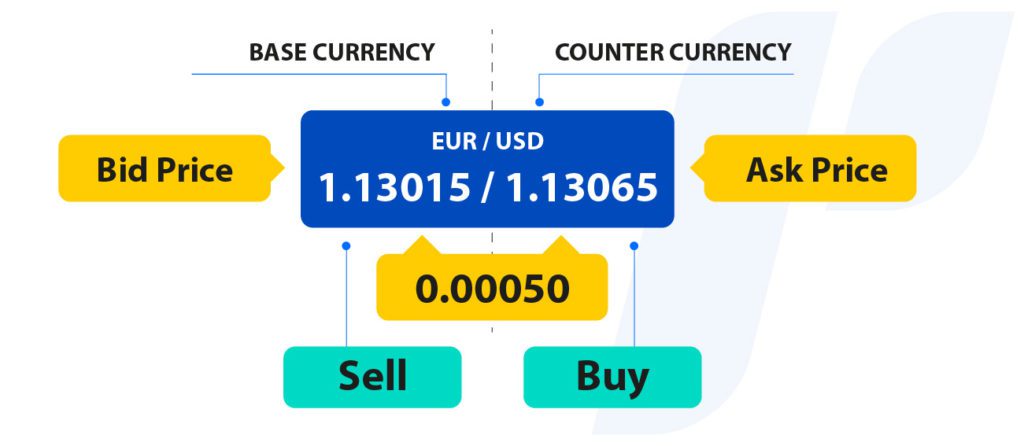

Bid price refers to the price at which the other party is willing to buy the base currency whereas Ask price refers to the price at which the other party is willing to sell the base currency. Spread refers to the difference between the bid price and the ask price.

Based on the quote we see from the image above, the bid price is 1.13015 euros and the ask price is 1.13065 usd. By calculating the difference in these two prices, the spread is determined to be 1.13065 – 1.13015 = 0.00050, or 5 pips.

In Forex Trading, to go long refers to buying an asset and to go short means selling it away. To earn profits, traders follow a strategy of “buying it low and selling it at high prices”, which means they tend to go long when the price of an asset is predicted to rise and go short when it is expected to fall.

“Going long” in Forex Trading means buying the base currency and selling the quote currency.

For example, the current exchange rate for EUR/USD = 1.1300. If you have predicted that the Euro was going to rise, you would go long on it so that you can sell it at a higher price once its value has risen.

Say, you enter a long position in the Euro at 1.1300, and the Euro eventually rises in value to 1.1400. Selling the Euro will net you a profit of $0.01 per unit traded. If you were trading 1 standard lot, you would net a profit of $1000.

“Going short” in Forex Trading is selling the base currency and buying the quote currency.

For example, the current exchange rate for EUR/USD = 1.1300. If you are expecting the Euro to fall, you would want to bet against it and enter a short position on the Euro at 1.1300. If the Euro falls to 1.1000, closing your position would net you a profit of $0.03 per unit traded. This is because you are essentially buying the Euro at 1.1000 to cover the Euro that you have sold earlier at 1.1300.

If you had shorted 1 standard lot of EUR/USD, you would have netted a profit of $3000 from selling 100,000 euros at $113,000 and covering it with 100,000 euros bought at $110,000.

Beginner forex traders can choose to trade forex in smaller amounts by taking positions in what is called a micro or mini lot. A mini lot is 10,000 units of the base currency, while a micro lot is 1,000 units of the base currency.

1 pip on a mini lot is worth 1 of the counter currency for most currencies. For Japanese Yen, 1 pip on a mini lot is worth 100 of the counter currency.

1 pip on a micro lot is worth 0.10 of the counter currency for most currencies. For Japanese Yen, 1 pip on a micro lot is worth 10 of the counter currency.

Are You Ready To Start Trading?

Margin in Forex Trading refers to the percentage of the full intended trade amount required for the trader to keep a trade position open. For instance, if a trader is looking to open a position worth $150,000 and the forex broker offers a 2% margin rate, they are required to provide $3000, known as the marginal amount, to enter the trade.

Consequently, the margin requirement is the inverse of the leverage offered by a broker.

Leverage enables you to trade larger position sizes with a smaller capital outlay. A trade with a 2% margin would thus mean a 1:50 leverage. This means that any capital put into this trade is amplified 50 times.

This, however, also comes with the risk of greater losses as well as your losses would also be amplified in the leveraging process.

Leverages are usually expressed as a ratio. A leverage ratio of 50:1 means that one can open a position worth 50 times their invested capital. Hence, a trader who has $3,000 available to open a trade can control a position with a total value of $150,000 if the leverage ratio is 50:1.

Now that you understand what pips and lots are, you can calculate the profits and losses in forex trading. The profits and losses are calculated by multiplying pip movements by position size. To calculate your profits and losses, you can do so using the following formula:

P&L = Price Movement x Position Size

Do note that the P&L is always expressed in the quote currency of your trade.

If you bought 2 standard lots of EUR/USD at 1.1205 and sold them at 1.1210, your position size would be 200,000, with a positive movement of 5 pips, or 0.0005. With the given formula, your P/L can be determined to be:

P/L = (1.1210 – 1.1205) x (100,000 x 2) = $100

In another example, you buy 1 lot of USD/AUD at 1.2917 and sell at 1.2932

P/L = (1.2932 – 1.2917) x 100,000 x 1 = 150 AUD

To convert the profit into USD, divide by the selling price as you’re selling AUD and buying USD

150 AUD/1.2932 = 115.99 USD

Are You Ready To Start Your Forex Trading Journey?

Register an account with PU Prime! The process is quick and simple, and you can begin trading currencies in as soon as an hour.

The minimum deposit required to open a PU Prime standard account is $50. For those who want to start smaller, our Cents account only requires a minimum deposit of $10.

A long position is a buy position, meaning that this position will be in profit if the currency rate goes up. A short position is a sell position, meaning that this position will be in profit if the currency rate goes down.

The term “bullish” is a term used to describe when a trader’s outlook on an asset is positive and will rise in price.

The term “bearish” is a term used to describe when a trader’s outlook on an asset is negative and will fall in price.

Trade with simulated capital and earn real profits after you pass our trader assessment.

2 February 2024, 03:37 Prop Trading vs. Traditional Trading: Unveiling Differences

27 September 2022, 08:05 How To Invest In And Trade Gold

16 March 2022, 10:04 The Psychology of Trading

New Registrations Unavailable

We’re not accepting new registrations at the moment.

While new sign ups are unavailable, existing users can continue their challenges and trading activities as usual.