Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

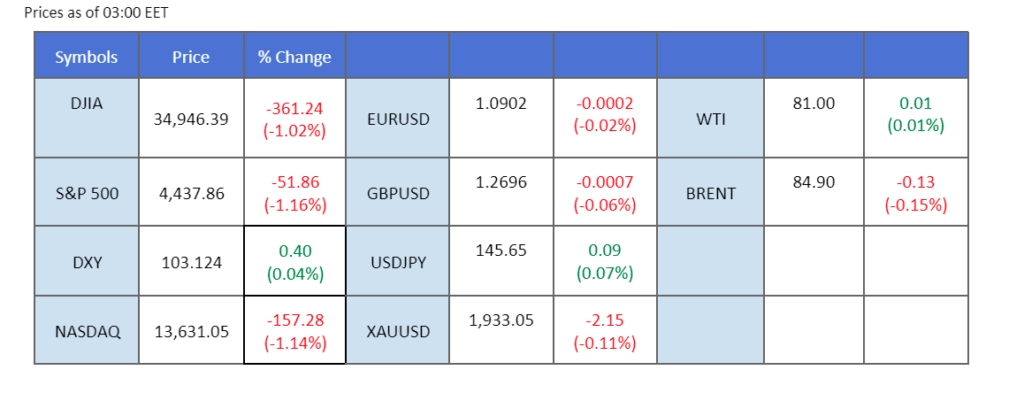

Last night, the spotlight was on U.S. retail sales data, which surpassed market expectations by coming in at 0.7%, an improvement from the previous figure of 0.3%. The increase in U.S. retail sales underscores the resilience of consumer spending in the country. This outcome triggered a decline in the U.S. equity market as investors speculated that the Federal Reserve would maintain a hawkish stance in its monetary policy approach. Meanwhile, the U.S. dollar maintained its position above the $103.00 mark, while gold prices experienced a significant drop, touching a critical support level at $1900. In the Asian equity markets, the downward pressure continued due to ongoing concerns about China’s economic challenges. Simultaneously, oil prices declined by nearly 2%, reflecting a shared sentiment across markets. Elsewhere, the Reserve Bank of New Zealand is poised to announce its interest rate decision. Market consensus suggests that the central bank of New Zealand is likely to keep the interest rate unchanged.

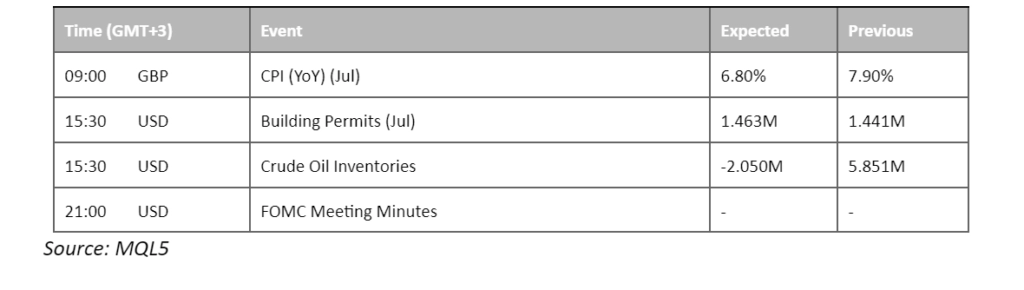

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86%) VS 25 bps (14%)

The US Dollar surged, propelled by robust retail sales data and climbing US Treasury yields. The better-than-expected consumer spending ignited optimism that the Federal Reserve could prolong its monetary tightening approach. US Core Retail Sales and Retail Sales outperformed projections, increasing by 1.0% and 0.70% respectively, surpassing the market’s negative estimations of -0.30% and 0.40%. This unexpected boost in consumer activity signalled a potential extension of the Federal Reserve’s tightening measures.

The dollar index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 65, suggesting the index might enter overbought territory.

Resistance level: 103.45, 104.50

Support level: 102.65, 102.10

Gold faced a downward trajectory, testing a critical support level around $1900 per troy ounce. The bearish sentiment for gold persisted due to the robust US Dollar, buoyed by upbeat economic indicators and mounting rate hike expectations from the CME FedWatch Tool.

Gold prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 33, suggesting the commodity might enter oversold territory.

Resistance level: 1930.00, 1945.00

Support level: 1900.00, 1885.00

The euro remains under downward pressure as the dollar gains strength. The U.S. retail sales figures climbed to 0.7%, a significant improvement over the preceding reading of 0.3%. Market speculation that the Federal Reserve could persist in its hawkish approach to monetary policy was reinforced by the U.S. retail sales data, demonstrating that consumer spending in the U.S. remains robust. Meanwhile, today’s focus is on the forthcoming eurozone GDP data release, anticipated to serve as a potential trigger for the Euro to rebound. The hope is that this economic indicator could contribute to reversing the Euro’s current trajectory.

The Euro continues to trade in a bearish momentum and is falling below its downtrend resistance level. The RSI flows in the lower region while the MACD is moving downward, suggesting a bearish signal for the pair as well.

Resistance level: 1.0998, 1.1090

Support level: 1.0849, 1.0762

The British Pound (Sterling) has exhibited a lateral trading pattern with a wide fluctuation range spanning from 1.2780 to 1.2670. Yesterday, the UK disclosed its average earning index figures. The data indicated an uptick from the preceding reading of 7.2% to the present reading of 8.2%, eliciting an immediate surge in Sterling’s value. However, this gain was swiftly erased due to the concurrent release of the unemployment rate figures. The unemployment rate climbed from the prior reading of 4% to the current reading of 4.2%. Concurrently, market participants are anticipating the release of the UK’s Consumer Price Index (CPI). This impending data announcement holds the potential to act as a catalyst for Sterling to rebound from its current phase of price consolidation within the given range.

The Sterling being able to withhold the strengthened dollar implies that the Sterling has strong support near the 1.2700 range. The RSI gradually moves upward while the MACD moves toward the zero line from below, suggesting a trend reversal for the Cable.

Resistance level: 1.2740, 1.2870

Support level: 1.2600, 1.2500

Asian equity markets, including the Hang Seng index, are grappling with persistent downward pressure attributed to China’s economic challenges. Adding to the concerns, the U.S. retail sales data demonstrated an increase, renewing apprehensions regarding a more hawkish stance from the Federal Reserve, dampening the appetite for risky assets. Despite the Chinese government’s commitments to implement additional policies to bolster the struggling economy, market sentiment remains fraught with worries. There are apprehensions that the distressed state of the Chinese property sector could potentially trigger a broader financial crisis within the region.

The Hang Seng index is facing a strong bearish momentum. The RSI declined sharply toward the oversold zone while the MACD diverged below the zero line suggesting a solid bearish momentum is intact with the index.

Resistance level: 18960, 19550

Support level: 18000, 17000

The 10-year Treasury yield reached its highest level since October, dampening US equity markets. The surge in yields diminished investor appetite for stocks, prompting a retreat in the Dow. On the other hand, Fitch Ratings analyst Chris Wolfie warned of potential downgrades for several US banks, including JP Morgan, if the health of the banking sector deteriorates further. This cautionary statement sent a wave of concern through the banking industry, contributing to a challenging day for US bank stocks.

The Dow is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 40, suggesting the index might extend its losses in the short-term since the RSI stays below the midline.

Resistance level: 35605.00, 36520.00

Support level: 34550.00, 33715.00

Chinese proxy currencies, such as the Australian and New Zealand Dollars (AUD & NZD), suffered losses due to downbeat economic data and market turmoil linked to the Chinese property sector and private wealth management issues. Disappointing industrial output and retail sales data from China exacerbated worries about already shaky growth. China’s industrial production dipped from 4.40% to 3.70%, missing market projections.

AUD/USD is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 33, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 0.6600, 0.6695

Support level: 0.6385, 0.6285

Oil prices witnessed a significant slump as concerns intensified over China’s sluggish economic outlook. Disappointing industrial output and retail sales data from China exacerbated worries about already shaky growth. China’s industrial production dipped from 4.40% to 3.70%, missing market projections. However, amidst the gloom, Chinese refinery throughput rose by 17.4% YoY in July, driven by demand for domestic summer travel. Additionally, US Crude stocks saw a noteworthy decline of 6.2 million barrels per day based on American Petroleum Institute figures.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 46, suggesting the commodity might extend its losses toward support level since the RSI stays below the midline.

Resistance level: 83.25, 87.25

Support level: 79.90, 76.90

Trade with simulated capital and earn real profits after you pass our trader assessment.

20 May 2025, 06:46 Gold Slips as Ceasefire Hopes Curb Safe-Haven Demand

7 May 2025, 03:59 Geopolitical Risks and FOMC Uncertainty Shake Global Markets

6 May 2025, 05:53 Dollar Dips, Gold Rallies on U.S.-Taiwan Risk

New Registrations Unavailable

We’re not accepting new registrations at the moment.

While new sign ups are unavailable, existing users can continue their challenges and trading activities as usual.