Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

17 April 2023,05:47

Daily Market Analysis

US index futures cautiously climbed during the Asian market session, signalling investors’ apprehension ahead of the upcoming earnings season. Against the backdrop of growing concerns over economic slowdown and the possibility of further rate hikes, market volatility is expected to remain high, particularly as major US companies brace themselves for disappointing earnings reports. Despite reports of easing inflation in the US economic data, the dollar index strengthened in the previous week, as the market anticipates another 25 bps increase by the Fed in May. The Fed also showed determination to bring the inflation rate down to 2%, with the majority of the Fed’s officials favouring more policy tightening to battle inflation. Oil prices traded steadily above $82 amid tightening supply and increasing demand; the China GDP data is set to be released tomorrow ( 18th April), which may potentially impact the oil prices.

Current rate hike bets on 3rd May Fed interest rate decision:

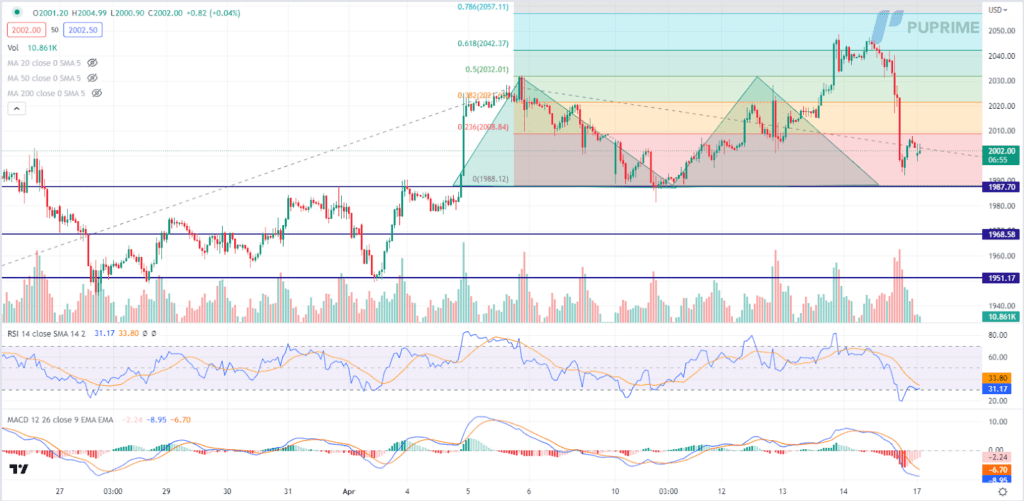

Source: CME Fedwatch Tool

0 bps (16.2%) VS 25 bps (83.8%)

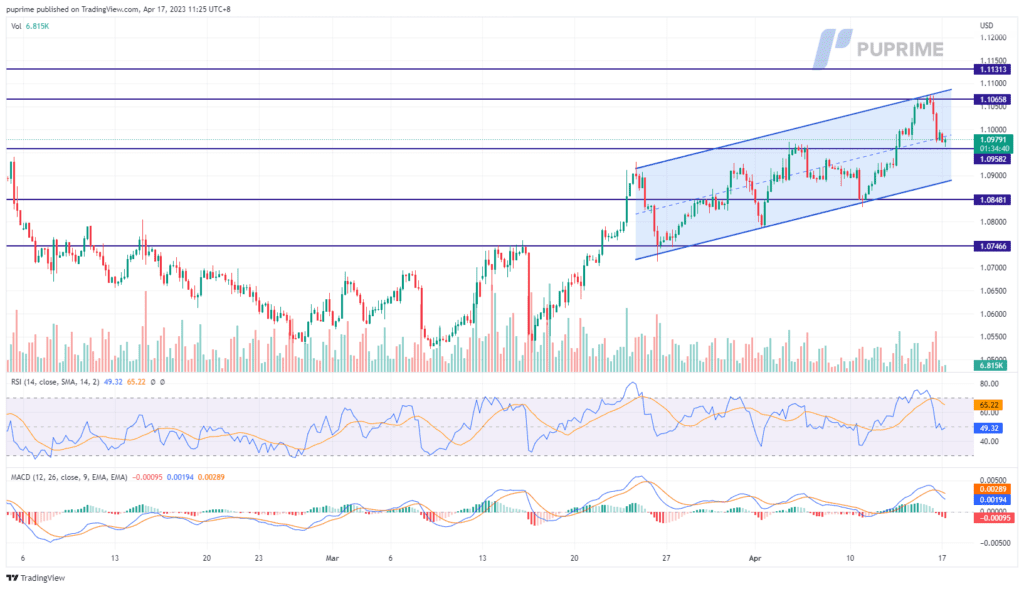

The Dollar Index, which measures the greenback’s strength against a basket of six major currencies, experienced a significant rebound last week, buoyed by a surge in US Treasury yields following a rate hike bet. In particular, the rate-sensitive two-year Treasury yields skyrocketed to around 4.1%, a weekly high, after a series of comments from Federal Reserve officials. The news sent shockwaves throughout the markets, with investors rattled by Fed Governor Christopher Waller’s suggestion that he favoured more monetary policy tightening to reduce persistently high inflation.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 102.70, 103.40

Support level: 101.55, 100.80

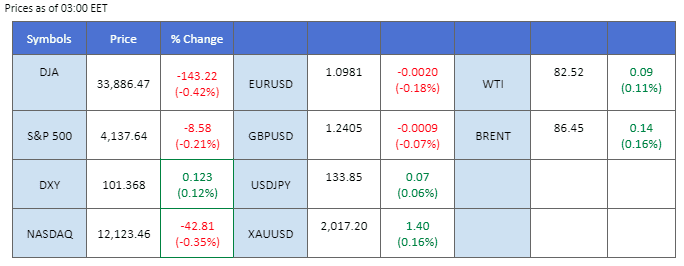

Gold prices experienced a sharp retreat from a crucial resistance level, weighed down by a strengthening US Dollar, following hawkish remarks by Federal Reserve policymakers regarding future monetary policy decisions. Fed Governor Christopher Waller’s recent statement in favour of further tightening to address persistent inflationary pressures sparked a surge in bullish momentum on the US Dollar and US Treasury yields. In particular, the rate-sensitive two-year Treasury yields soared to a weekly high of approximately 4.1%, driven by a series of comments from Fed officials.

Gold prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 31, suggesting the commodity might trade higher as technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 2010.00, 2021.00

Support level: 1990.00, 1970.00

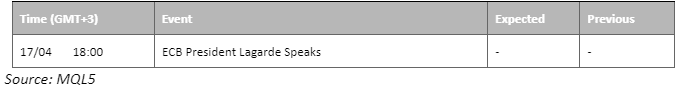

The euro retraced and traded below its crucial level at 1.1000 after hitting its highest level since last April. Mainly due to a technical rebound from the U.S. dollar as the DXY experienced a rebound at near $101 level with the expectation that the Fed will continue to raise the interest rate. Despite showing signs of easing in inflation in the U.S., the market widely believed that the Fed may add another 25 bps in the Fed rate determined to bring down the inflation rate to 2%. The Eurozone CPI data will be released this week and the market expects the CPI data is not slowing down. A constantly Hawkish stance from the ECB may continue to boost the euro against the weakening dollar if the CPI reading exceeds the market consensus.

The pair has retraced and traded below its crucial price level at 1.1000 after hitting its highest since last April. Both RSI and MACD showed that the bullish momentum for the pair has eased however, the pair is still trading in its uptrend channel.

Resistance level: 1.1066, 1.1131

Support level: 1.0958, 1.0848

On Friday, the Nasdaq index closed in the red as a deluge of conflicting economic data reinforced the Federal Reserve’s expectations for another interest rate hike. The index dropped 0.35% to finish the day at 12,123 points. The latest earnings reports from major U.S. banks have exceeded market expectations, signalling a potentially stronger economy than previously anticipated. Analysts believe this could lead to increased pressure on the Federal Reserve to continue its current trajectory of raising interest rates. The mixed economic signals have left market analysts uncertain about the direction of the U.S. economy as investors brace for potential volatility in the weeks ahead.

The MACD line still hovers above zero, indicating bullish momentum continues. RSI is at 56, indicating a bullish momentum ahead.

Resistance level: 12250, 12580

Support level: 11948, 11761

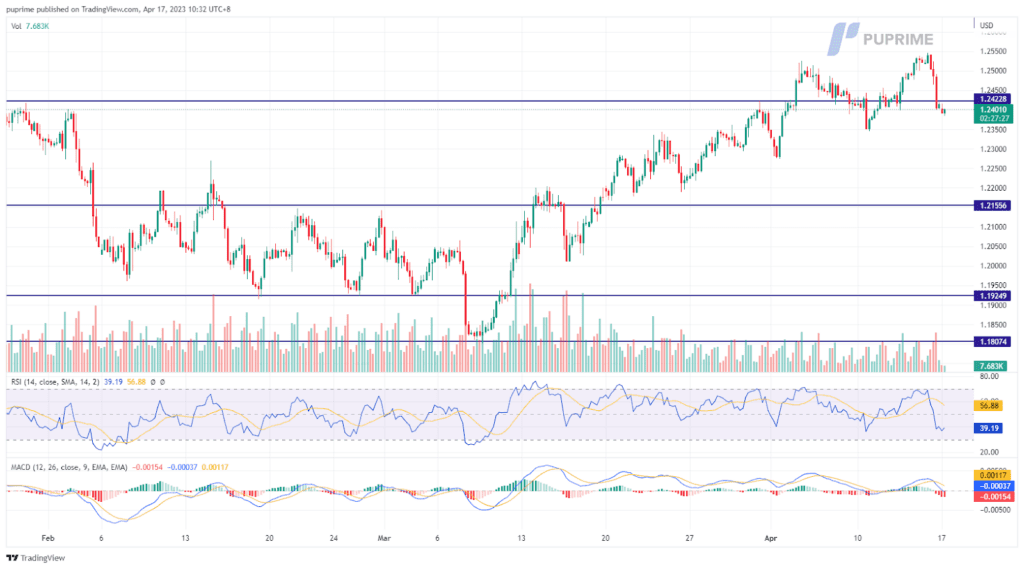

The pound slumped 1.23% to $1.2401 against the strengthened dollar on Friday. In a surprise turn of events, the latest earnings reports from major U.S. banks have exceeded market expectations, signalling a potentially stronger economy than previously anticipated. Analysts believe this could lead to increased pressure on the Federal Reserve to continue its current trajectory of raising interest rates. The positive bank earnings results have sparked optimism among investors and prompted speculation about the future direction of the U.S. economy. It leads to a stronger dollar, prompting the pound to drop.

The pound has already broken its support level of $1.2422. The MACD line is falling to zero, indicating a diminishing bullish momentum. RSI is at 39, indicating the pair has entered into bearish momentum.

Resistance level: 1.2613,1.2740

Support level: 1.2425,1.2298

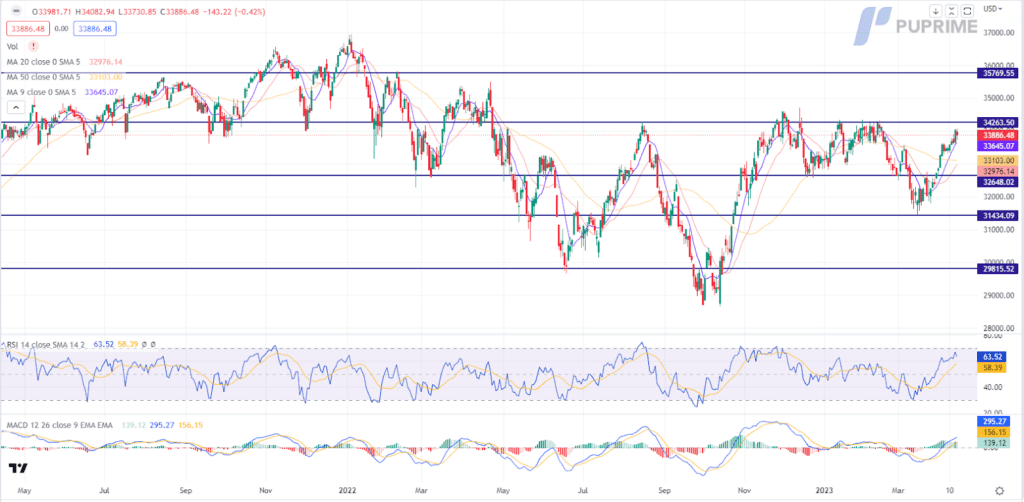

The Dow Jones experienced a slight dip, causing concern among investors who feared that a bleak retail sales report had dampened the previously optimistic sentiment surrounding strong corporate earnings. The US Census Bureau released data indicating retail sales had plummeted by 1.0%, a significant deviation from the market’s anticipated -0.40%. Nevertheless, the Dow stood for the fourth consecutive week of gains, boasting a 1.20% increase. Despite the sombre news regarding retail sales, the robust corporate earnings were a buoyant force for the stock market. JPMorgan Chase made headlines for surpassing analysts’ expectations with record revenue, resulting in a more than 7.00% surge in stock value.

The Dow is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 64, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 34265.00, 35770.00

Support level: 32650.00, 31435.00

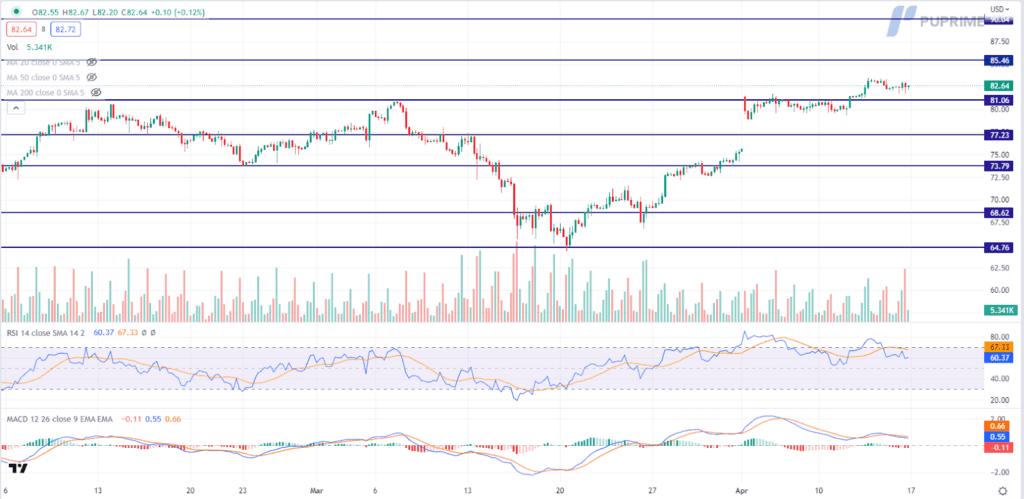

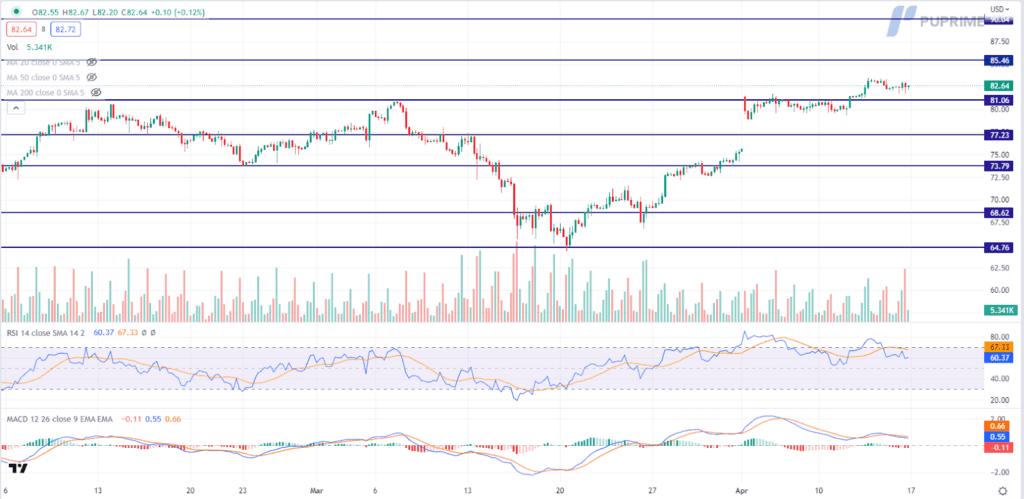

Oil prices extended gains for the fourth consecutive week, supported by an optimistic demand outlook for 2023 from the International Energy Agency (IEA). However, the rally was limited by the US Dollar’s resurgence, which typically negatively impacts commodity prices. On Friday, crude oil prices relinquished some of their upward momentum due to a technical correction following remarks made by Fed Governor Waller in favour of more rate hikes, which tend to boost the US Dollar and weigh on oil prices.

Oil prices are trading flat while currently near the support level. However, MACD has illustrated increasing bearish momentum, while RSI is at 60, suggesting the commodity might trade lower since the RSI retreated sharply from overbought territory.

Resistance level: 85.45, 90.04

Support level: 81.06, 77.25

Trade with simulated capital and earn real profits after you pass our trader assessment.

20 May 2025, 06:46 Gold Slips as Ceasefire Hopes Curb Safe-Haven Demand

7 May 2025, 03:59 Geopolitical Risks and FOMC Uncertainty Shake Global Markets

6 May 2025, 05:53 Dollar Dips, Gold Rallies on U.S.-Taiwan Risk

New Registrations Unavailable

We’re not accepting new registrations at the moment.

While new sign ups are unavailable, existing users can continue their challenges and trading activities as usual.