Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

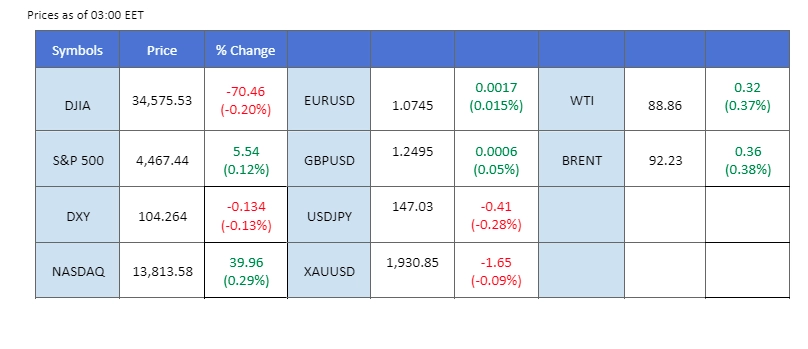

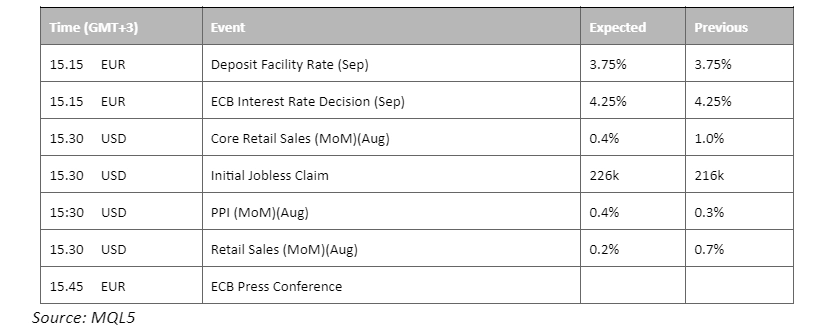

Yesterday’s U.S. CPI release showed a higher reading than both the forecasted number and the previous reading. However, it appeared that the market had already priced in this uptick in CPI, and there was a relatively muted reaction as the data indicated that inflation in the U.S. remained persistent. In contrast, Australia’s job data for August revealed a significant increase in employment change, improving from a previous reading of -1.4k to 64.9k, while the unemployment rate remained unchanged. This positive employment data provided support for the Australian dollar. Meanwhile, all eyes are on the European Central Bank (ECB) as it is scheduled to announce its interest rate decision today. This announcement may provide guidance for investors and help gauge the strength of the euro.

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (93.0%) VS 25 bps (7.0%)

The US dollar displayed an unexpected lack of movement during yesterday’s trading session, despite the release of the US Consumer Price Index (CPI), which indicated an uptick in the country’s inflation rate. Market sentiment had already factored in the likelihood of a higher CPI reading for August. The dollar index is presently maintaining its strength, trading above the $104.5 level, as expectations for at least one more rate hike from the Federal Reserve by the end of the year loom on the horizon.

The dollar index lost steam after it touched the $105 mark last week. The RSI hovers near the 50-level while the MACD stays flat near to the zero line giving a neutral signal for the index.

Resistance level: 105.25, 106.25

Support level: 104.25, 103.05

Gold prices were affected by the higher-than-expected US CPI reading released yesterday, causing them to edge lower. However, the market appears to have already anticipated this increase in CPI and mitigated its negative impact on gold prices. Additionally, concerns about China’s economic situation and a pessimistic global economic outlook continue supporting gold prices.

Gold prices have a lower-high pattern, suggesting the gold price is trading in a bearish trend. The RSI and the MACD are flowing in the lower territory, suggesting a bearish bias for gold prices as well.

Resistance level: 1938.00, 1967.00

Support level: 1900.00, 1870.00

The euro has been trading sideways for nearly a week, holding its ground against the strong dollar. Today, the ECB is set to announce its interest rate decision, which could introduce some volatility to the currency pair. The sluggish economic performance in the eurozone has led to market speculation of an interest rate pause by the ECB. However, if the ECB surprises with a rate hike, it could boost the euro’s strength against the dollar.

EUR/USD has consolidated for nearly a week and has a sign of rebounding. The RSI gradually moves upward while the MACD breaks above the zero line, suggesting the bullish momentum is forming.

Resistance level: 1.0760, 1.0850

Support level: 1.0700, 1.0640

The British pound has found some stability against the USD, largely due to the dollar index trading in a sideways pattern as it awaits a catalyst to determine its direction. However, investor confidence in the Sterling has been waning recently due to the lacklustre performance of the UK economy and the bankruptcy declaration of Birmingham’s city council. The UK is set to release its CPI data next week, which presents a challenge for the Bank of England (BoE) regarding its interest rate policy decisions. Both the CPI announcement and the BoE interest rate decision can potentially drive movements in the Cable.

The Sterling has eased from its bearish momentum and has broken above its long-term resistance level. The RSI is gradually moving up while the MACD is approaching the zero line from below, suggesting the bullish momentum is forming.

Resistance level: 1.2540, 1.2640

Support level: 1.2460, 1.2390

The Japanese yen is trading within a wider range, just below a significant resistance level at 147.80. It continues to exhibit strength, partly due to remarks made by the BoJ governor suggesting that the Japanese authorities might consider moving away from negative interest rates by the end of the year. This sentiment has bolstered the yen’s performance.

USD/JPY seems to be trading in a wide range from 146.10 to 147.80 while speculators continue to test the Japanese authority limit. The RSI is hovering near the 50-level range while the MACD fluctuates between the zero line, with both giving a neutral signal for the pair.

Resistance level: 148.80, 151.45

Support level: 145.00, 141.90

The Nasdaq and other U.S. equity indexes appeared unfazed by yesterday’s higher U.S. CPI reading. Leading companies like Tesla, Meta, and Amazon saw gains of over 1%, contributing to the index closing higher. The inflationary pressures indicated by the CPI, lead the market to expect at least one more rate hike from the Fed before the year’s end, as the targeted 2% inflation rate has not been reached yet.

Nasdaq’s bullish momentum is losing steam and is suppressed under a strong resistance level at 15780. The RSI is still hovering at a higher level while the MACD stays flat, suggesting the index is still trading in a bullish momentum but the momentum is weak.

Resistance level: 15780.00, 16585.00

Support level: 14610.00, 13660.00

The Australian dollar has gradually advanced after consolidating near its lowest level since November at 0.6370. Surprisingly, the uptick in U.S. CPI data didn’t exert downward pressure on the Aussie dollar. Market participants are now eagerly awaiting the release of Australia’s employment report, scheduled for today. Expectations are for a positive change in employment of 23,000 in August, which could increase the currency pair.

The AUD/USD pair’s bullish momentum seems sustainable after consolidating at the near 0.6370 range. The RSI is approaching the overbought zone while the MACD is hovering flat above the zero line, suggesting that bullish momentum is forming.

Resistance level: 0.6500,0.6610

Support level: 0.6370, 0.6200

Oil prices continued their upward trajectory, reaching a new 10-month high. Expectations of tightened global supply and concerns over supply disruptions in Libya outweighed worries about reduced demand in certain countries like China. The closure of Libyan oil export terminals due to a severe storm further supported oil prices. OPEC’s optimistic outlook on global oil demand growth in 2023 and 2024 adds to the bullish sentiment.

Oil prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 70, suggesting the commodity might enter the overbought territory.

Resistance level: 92.30, 95.80

Support level: 87.70, 84.45

Trade with simulated capital and earn real profits after you pass our trader assessment.

20 May 2025, 06:46 Gold Slips as Ceasefire Hopes Curb Safe-Haven Demand

7 May 2025, 03:59 Geopolitical Risks and FOMC Uncertainty Shake Global Markets

6 May 2025, 05:53 Dollar Dips, Gold Rallies on U.S.-Taiwan Risk

New Registrations Unavailable

We’re not accepting new registrations at the moment.

While new sign ups are unavailable, existing users can continue their challenges and trading activities as usual.