Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

25 October 2024,01:17

Trade Of The Day

Tags:

* Risk-Off Sentiment: In the short term, better-than-expected US economic data has shifted market sentiment, sparking a selloff in gold as investors gravitate towards riskier assets. Nonetheless, the long-term outlook for gold remains bullish, driven by heightened geopolitical tensions in the Middle East and the uncertainty surrounding the upcoming US Presidential Election. Additionally, China’s prolonged economic slowdown, despite recent stimulus measures, continues to add a layer of global uncertainty, supporting demand for safe-haven assets like gold.

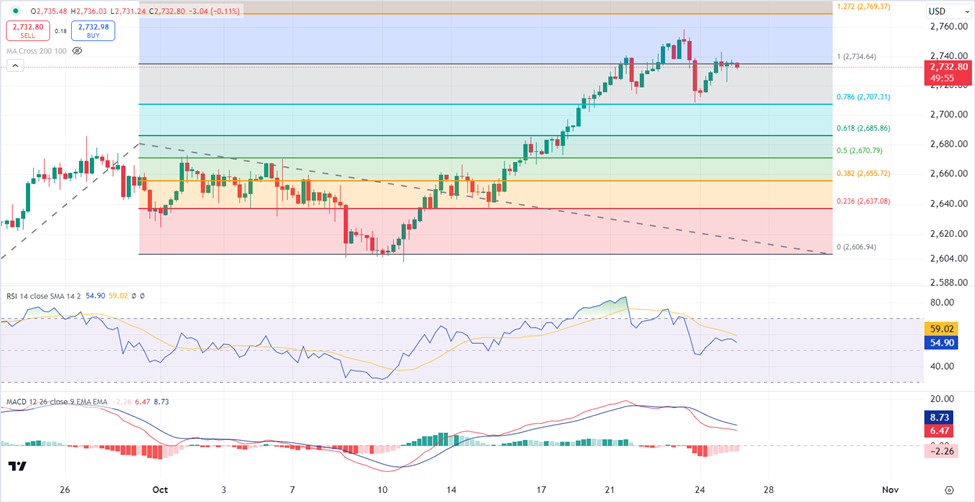

* Testing Resistance Level: Currently, gold prices are testing a key resistance level. The MACD is showing signs of weakening bearish momentum, while the RSI stands at 55, indicating a potential for further gains if a breakout occurs. The technical setup suggests that the bulls may continue to drive prices higher if the resistance level is breached.

* Resistance and Support: Should bullish momentum persist, a breakout above the resistance level of 2735.00 could see gold prices advancing towards 2770.00, in line with Fibonacci expansion projections. However, failure to break through this level may lead to a retracement, with the potential support level to watch at 2685.00.

A key risk factor to consider is the rise in US Treasury yields, which, combined with an improving US economic outlook, could diminish the appeal of dollar-denominated gold. Any significant upward movement in yields may pressure gold prices in the short term.

Learn more about how to navigate the prop trading landscape by checking out PU Xtrader’s trading blogs.

Stay vigilant on developments in the Middle East, the US Presidential elections, and potential shifts in the Federal Reserve’s monetary policy. These factors will likely play a pivotal role in influencing the next major moves in gold prices. Stays updates on the latest market development by following PU Xtrader’s financial news page.

Register For PU Xtrader Challenge And Start Prop Trading

Take Challenge

Trade with simulated capital and earn real profits after you pass our trader assessment.

29 April 2025, 02:02 NASDAQ (NDX) Flat, Eye on Tech Earnings

28 April 2025, 05:30 HK50 Tests Resistance as China Unveils New Economic Support

25 April 2025, 06:45 Nasdaq Continues Uptrend as Tech Earnings Boost Market Sentiment

New Registrations Unavailable

We’re not accepting new registrations at the moment.

While new sign ups are unavailable, existing users can continue their challenges and trading activities as usual.