Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

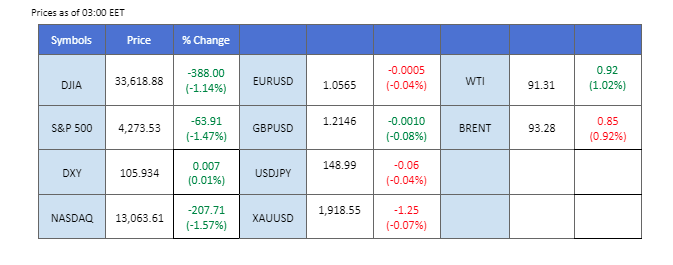

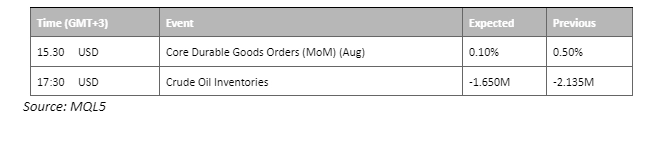

In the realm of U.S. equity markets, the dominant theme remains the Federal Reserve’s resolute hawkish stance, indicating an enduring era of monetary tightening. This posture has cast a shadow over tech-heavy indices, as the spectre of heightened borrowing costs looms. Concurrently, the U.S. dollar has emerged as the premier safe-haven asset, eclipsing both the yen and gold, especially when the United States grapples with the spectre of a government shutdown. Meanwhile, the price of oil has staged a remarkable recovery, breaching the $90 mark. This resurgence comes on the heels of the market digesting the Federal Reserve’s monetary policy outlook. Remarkably, it rides high on the back of robust oil fundamentals, despite the surprising uptick in U.S. crude oil stockpiles as the U.S. API report revealed.

Current rate hike bets on 1st November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (68.0%) VS 25 bps (32%)

The US Dollar continued its robust performance, bolstered by climbing US bond yields. Despite a slew of underwhelming US economic data, including the Housing Price Index and Consumer Confidence Index, investors maintain a bullish stance, driven by expectations of Federal Reserve rate hikes. As the week progresses, market participants should keep a keen eye on upcoming economic data releases, particularly GDP figures, Initial Jobless Claims, and the PCE Price Index. These data points are poised to provide critical signals for future trading decisions.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the index might enter overbought territory.

Resistance level: 106.25, 107.05

Support level: 105.40, 104.25

The gold market finds itself grappling with a pivotal psychological support level at $1900 per troy ounce. Persistent expectations of rate hikes and rising yields from major central banks, such as the Federal Reserve and the European Central Bank (ECB), have exerted downward pressure on this non-yield bearing commodity.

Gold prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 28, suggesting the commodity might enter oversold territory.

Resistance level: 1930.00, 1950.00

Support level: 1900.00, 1885.00

The euro remains entrenched in a bearish trajectory, recording a decline of over 0.7% for the week. This downturn is primarily attributed to the highest treasurie yield in a decade, a direct consequence of the Federal Reserve’s resolute Hawkish stance. This upward momentum has propped up the dollar, anchoring it firmly above the $106 threshold. Adding to the dollar’s allure is its status as the favoured safe-haven asset, particularly pronounced amid mounting concerns regarding a potential U.S. government shutdown. These prevailing conditions continue to bolster the dollar’s position.

EUR/USD continues to trade with a strong bearish momentum. The RSI is on the brink of breaking into the oversold zone while the MACD continues declining, suggesting the bearish momentum is strong.

Resistance level: 1.0638, 1.0700

Support level: 1.0540, 1.0460

The GBP/USD pair saw a substantial 1% drop this week, fueled by the widening disparity in monetary policy between the two central banks. As concerns over a U.S. government shutdown loom, the dollar remains a robust safe-haven asset, firmly trading above the $106 mark. Meanwhile, the recent BoE interest rate decision continues to weigh on Sterling. Investor focus now pivots to the eagerly anticipated UK GDP report set to release on Friday. Hopes are high that this data could provide the catalyst needed to spur a Sterling recovery.

GBP/USD is trading in a strong bearish momentum and has declined sharply after forming a bearish engulfing candlestick pattern. The RSI has broken into the oversold zone while the MACD continues to slide, suggesting a strong bearish momentum.

Resistance level: 1.2210, 1.2310

Support level: 1.2110, 1.2020

The Australian Dollar, often seen as a proxy for the Chinese economy, faces downward pressure. Lingering concerns regarding the Chinese property sector, exacerbated by Evergrande Group’s missed payments on onshore bonds, have cast a shadow over the economic outlook in China.

The AUD/USD is trading lower while currently near thes support level. MACD has illustrated diminishing bullish momentum, while RSI is at 39, suggesting the pair will extend its losses after breakout since the RSI stays below the midline.

Resistance level: 0.6495, 0.6635

Support level: 0.6370, 0.6280

The US equity market experienced a dip as US 10-year Treasury yields reached multi-year highs. Investors remain on edge, anticipating an extended period of elevated interest rates and potential economic repercussions. JPMorgan CEO Jamie Dimon sounded a warning bell, suggesting that the Federal Reserve might push rates as high as 7% if inflation remains above expectations.

The Dow is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, RSI is at 30, suggesting the index might enter oversold territory.

Resistance level: 34355.00, 34900.00

Support level: 33590.00, 32745.00

The USD/JPY pair has surged to an 11-month peak, with market participants pushing the boundaries, testing the waters before potential intervention by Japanese authorities to stabilise their currency. In the minutes from the Bank of Japan’s July meeting, insights emerge indicating optimism. Several board members expressed that companies were poised to continue raising wages the following year. Furthermore, some members suggested the possibility of the Bank of Japan discerning that its long-pursued inflation target could be achieved as early as the first quarter of 2024.

USD/JPY continues to trade on an uptrend basis, and the pair is predicted to be trading toward the 150 mark. The RSI is on the brink of breaking into the overbought zone while the MACD continues to increase, suggesting the bullish momentum is still strong.

Resistance level: 149.30, 151.45

Support level: 147.80, 146.20

Oil prices staged a rebound from crucial support levels, buoyed by expectations of tighter supply conditions. Notably, Russia and Saudi Arabia extended their production cuts through the year’s end, providing a boost to oil prices. However, lingering uncertainty in the economic landscape remains a concern, as central banks like the Federal Reserve and ECB emphasise their commitment to combat inflation, hinting at prolonged tight monetary policies.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 57, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 90.70, 92.45

Support level: 88.50, 86.80

Trade with simulated capital and earn real profits after you pass our trader assessment.

20 May 2025, 06:46 Gold Slips as Ceasefire Hopes Curb Safe-Haven Demand

7 May 2025, 03:59 Geopolitical Risks and FOMC Uncertainty Shake Global Markets

6 May 2025, 05:53 Dollar Dips, Gold Rallies on U.S.-Taiwan Risk

New Registrations Unavailable

We’re not accepting new registrations at the moment.

While new sign ups are unavailable, existing users can continue their challenges and trading activities as usual.