Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

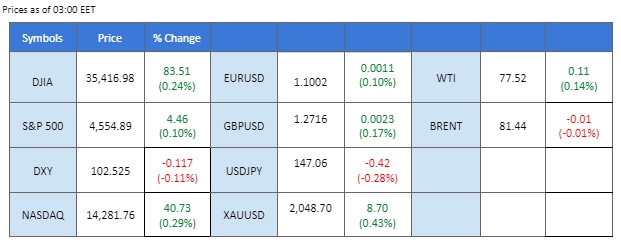

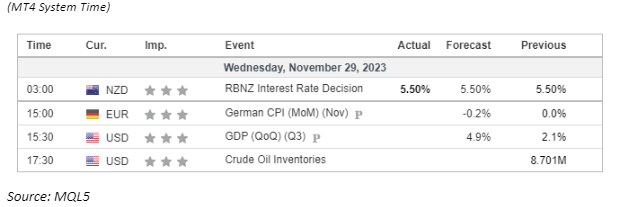

Prominent figure on Wall Street, Bill Ackman, is speculating that the Federal Reserve (Fed) is poised to cut rates as early as the first quarter of the upcoming year. This anticipation aligns with a consistent delivery of dovish statements by Fed officials. Concurrently, market expectations hint at another rate pause in December, a sentiment that has triggered a decline in the U.S. dollar. The long-term Treasury yield in the United States has concurrently dipped to its lowest level since September, fostering a surge in bond prices. This surge, in turn, has propelled gold prices higher as the market perceives a more uncertain economic landscape ahead. In addition, the Reserve Bank of New Zealand opted to maintain its current interest rates, yet hinted at a potential future increase if pricing risks were to escalate. This hawkish statement resonated in the market, leading to a notable surge in the New Zealand dollar.

Current rate hike bets on 13rd December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (96.0%) VS 25 bps (4%)

Dovish sentiments prevail among Federal Reserve policymakers, notably emphasized by Fed Governor Christopher Waller, who asserts that current inflation trends align with the Fed’s objectives. His confidence in the existing policy to manage the economy and steer inflation back to the 2% target hints at potential interest rate cuts if inflation persists on a downward trajectory. This dovish stance contributes to the US Dollar’s significant dip, reaching its lowest point in over three months.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 23, suggesting the index might enter oversold territory.

Resistance level: 103.05, 103.60

Support level: 102.50, 101.90

The US Dollar’s depreciation serves as a robust catalyst for dollar-denominated gold, which experiences an aggressive surge amid heightened expectations of a dovish Federal Reserve. With uncertainties looming ahead of the Core PCE report, gold emerges as a safe-haven asset, drawing substantial demand from investors seeking refuge in times of market unpredictability.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 86, suggesting the commodity might enter overbought territory.

Resistance level: 2050.00, 2080.00

Support level: 2025.00, 2005.00

The British Pound (Sterling) exhibited robust trading against the U.S. dollar, surpassing its uptrend resistance level. This impressive performance is due to the divergence in monetary policy between the 2 nations; the Bank of England’s (BoE) hawkish stance contradicts the Federal Reserve’s (Fed) consistent dovish statements, fostering market beliefs that the Fed might initiate rate cuts in the coming year. This has intensified downside pressure on the U.S. dollar, further contributing to the strength of the British Pound.

GBP/USD is trading in an extremely bullish momentum, breaking its September high. The RSI has once again broken into the overbought zone while the MACD continues to flow above the zero line, suggesting that the bullish momentum is strong.

Resistance level: 1.2729 1.2815

Support level: 1.2630, 1.2528

The Euro has reached its highest level against the U.S. dollar since August, primarily driven by the dollar’s weakening. The consistent delivery of dovish statements by the Federal Reserve (Fed) has heightened market expectations of a potential rate cut by the Fed next year, putting pressure on the dollar’s strength. Concurrently, the U.S. long-term Treasury yield has slid to its lowest point since September, further contributing to the dollar’s diminished resilience. Adding to the currency dynamics, the Eurozone’s Consumer Price Index (CPI) is slated for release tomorrow, with market participants anticipating its potential impact on the Euro’s strength.

EUR/USD has formed another uptrend channel and is currently firmly trading within the channel, suggesting a bullish bias for the pair. The MACD is moving lower, but the RSI is constantly flowing in the upper region, suggesting the bullish momentum is still intact but easing in momentum.

Resistance level: 1.1041, 1.1138

Support level: 1.0950, 1.0860

US equity markets register an upward trend as investors digest the dovish expectations set by the Federal Reserve. The potential for interest rate cuts in 2024, as suggested by several Federal Reserve members, prompts a favorable market response. US Treasury yields retreat, contributing to the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite all making gains in the wake of the dovish signals.

The Dow is trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 76, suggesting the index might enter overbought territory.

Resistance level: 35465.00, 35930.00

Support level: 34935.00, 34370.00

The USD/JPY pair has descended to its lowest level since mid-September, signalling a prevailing bearish momentum. The U.S. dollar’s ongoing decline is evident, particularly in anticipation of tomorrow’s upcoming U.S. Personal Consumption Expenditures (PCE) data. The persistently dovish expectations surrounding the Federal Reserve (Fed) contribute to the downward pressure on the dollar. Concurrently, the increased likelihood of a policy shift by the Bank of Japan (BoJ) has bolstered the strength of the Japanese Yen, further intensifying the pressure on the USD/JPY pair.

The USD/JPY continues to retrace, forming a lower-low price pattern suggesting a bearish bias for the pair. The RSI is breaking into the oversold zone while the MACD declines from below the zero line, suggesting the bearish momentum is strong.

Resistance level: 147.48, 148.30

Support level: 146.50, 145.50

The New Zealand dollar demonstrated strength against the U.S. dollar, reaching and touching its psychological resistance level at 0.6200, a point last observed in early August. Notably, this ascent occurred despite the Reserve Bank of New Zealand maintaining its current interest rate. The Kiwi’s resilience can be attributed to a hawkish statement from the New Zealand central bank, which has bolstered the currency. In contrast, the U.S. long-term Treasury yield continued its decline, exerting downward pressure on the strength of the U.S. dollar.

Kiwi exhibits an extremely bullish trend against the U.S. dollar and is breaking above its psychological resistance level at 0.6200. The RSI once again broke into the overbought zone while the MACD continued to flow above the zero line, suggesting the bullish momentum was strong.

Resistance level: 0.6200, 0.6260

Support level: 0.6150, 0.6080

Crude oil prices experience a modest uptick, propelled by the depreciation of the US Dollar and the anticipation of potential OPEC+ output cuts. The upcoming OPEC+ meeting, where discussions on output levels for 2024 are on the agenda, adds to the positive sentiment in the oil market. Meanwhile, US Crude inventories show a decrease, as reported by the American Petroleum Institute (API).

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 55, suggesting the commodity might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 78.30, 80.75

Support level: 74.50, 72.05

Trade with simulated capital and earn real profits after you pass our trader assessment.

20 May 2025, 06:46 Gold Slips as Ceasefire Hopes Curb Safe-Haven Demand

7 May 2025, 03:59 Geopolitical Risks and FOMC Uncertainty Shake Global Markets

6 May 2025, 05:53 Dollar Dips, Gold Rallies on U.S.-Taiwan Risk

New Registrations Unavailable

We’re not accepting new registrations at the moment.

While new sign ups are unavailable, existing users can continue their challenges and trading activities as usual.