Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

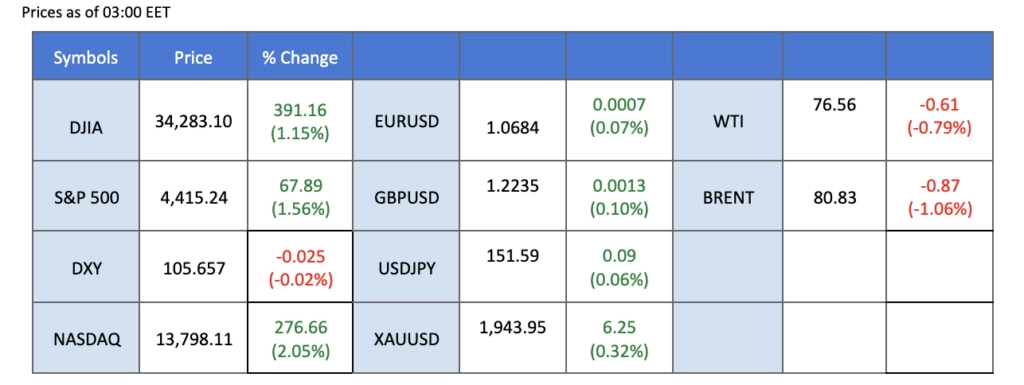

The US Dollar staged a significant rebound driven by hawkish sentiments from Federal Reserve members, particularly emphasised by Federal Reserve Bank of San Francisco President Mary Daly. This resurgence was marked by a notable retreat in gold prices, echoing the Dollar’s strength. Investors are closely watching the US Consumer Price Index (CPI) data for October to gain insights into the Fed’s strategy against inflation, which could sway the Dollar’s trajectory. Meanwhile, Pound Sterling exhibited resilience on positive economic data, and oil prices saw a modest rebound on the expectations upon OPEC+ production cuts. The US equity market recovered, but Moody’s negative outlook on the US credit rating raises caution.

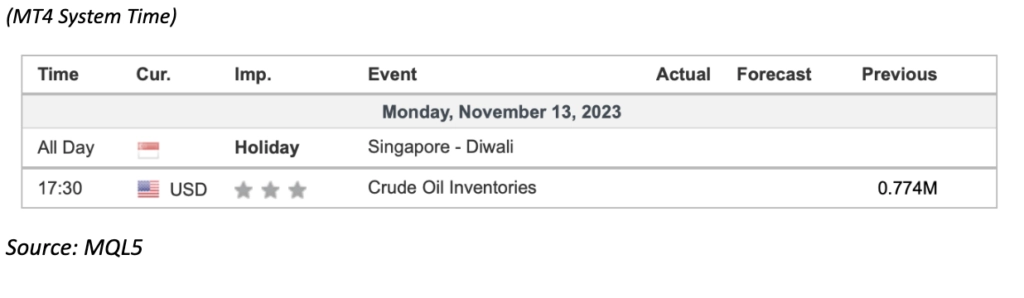

Current rate hike bets on 13rd December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86.0%) VS 25 bps (14%)

DOLLAR_INDX, H4

The US Dollar staged a notable rebound last Friday, propelled by hawkish statements from Federal Reserve members. Federal Reserve Bank of San Francisco President Mary Daly indicated a reluctance to conclude the Fed’s interest rate tightening, reinforcing the possibility of an extended tightening monetary policy cycle if inflation persists.

The Dollar Index is trading higher following the prior rebound from the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 53, suggesting the index might trade lower as technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 106.10, 106.75

Support level: 105.40, 104.80

Gold prices experienced a retreat against the backdrop of a strengthening US Dollar, driven by last week’s hawkish comments from several Federal Reserve members. Despite uncertainties in the market, including upcoming talks from Fed Chair Jerome Powell and CPI data, investors are advised to exercise caution in their trading strategies.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 31, suggesting the commodity might enter oversold territory.

Resistance level: 1960.00, 1980.00

Support level: 1940.00, 1915.00

The Euro experienced a bearish trend last week, largely influenced by the appreciation of the US Dollar. With uncertainties lingering, investors are advised to closely monitor the upcoming US Consumer Price Index (CPI) data and Federal Reserve speeches for potential trading signals in the Euro market.

EUR/USD is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 51, suggesting the pair might experience technical correction since the RSI stays above the midline.

Resistance level: 1.0765, 1.0835

Support level: 1.0665, 1.0530

Pound Sterling demonstrated resilience supported by a series of upbeat economic data. The UK Gross Domestic Product (GDP) surpassed market expectations, registering a growth of 0.60%. However, the positive GDP figures failed to trigger a significant market reaction, as investors await key events to gauge the potential trend for Pound Sterling..

GBP/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 43, suggesting hte commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 1.2305, 1.2415

Support level: 1.2205, 1.2060

The US equity market extended its gains, recovering ground lost in the previous session as US Treasury yields stabilised. Despite this positive momentum, investors in the US equity market are urged to exercise caution following Moody’s decision to lower its outlook on the US credit rating to negative from stable. The downgrade, attributed to large fiscal deficits and a decline in debt affordability, has the potential to diminish risk appetite in the market.

Nasdaq is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 72, suggesting the index might enter overbought territory.

Resistance level: 15780.00, 16375.00

Support level: 15190.00, 14610.00

The Australian Dollar maintained a bearish stance despite the Reserve Bank of Australia’s recent interest rate hike. The Monetary Policy Committee’s expectations that Australia’s inflation has peaked, coupled with stabilised and forecasted declining wages growth over the next few years, contribute to the subdued performance of the Australian Dollar.

AUD/USD is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 32, suggesting the pair might enter oversold territory.

Resistance level: 0.6395, 0.6510

Support level: 0.6300, 0.6205

USD/JPY continued its upward trajectory, fueled by a widening yield differential between the US and Japan. The hawkish tone from Fed members prompted investors to shift their portfolios into the US Dollar, resulting in significant selloff in the Japanese yen. Investors are closely monitoring potential currency intervention signals from the Bank of Japan for further trading signals.

USD/JPY is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 70, suggesting the pair might enter overbought territory.

Resistance level: 151.70, 152.70

Support level: 150.40, 149.30

Oil prices rebounded slightly following statements from Iraq expressing support for OPEC+ oil production cuts ahead of the group’s meeting on November 26. However, the gains in the oil market were tempered by concerns over a global economic growth slowdown, particularly in major oil importer China. Recent downbeat economic data from China raised doubts about policymakers’ ability to boost economic growth, impacting the outlook for a broad-based recovery.

Oil prices are trading higher while currently near the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 44, suggesting the commodity might experience technical correction since the RSI stays below the midline.

Resistance level: 78.15, 80.75

Support level: 75.35, 73.35

Trade with simulated capital and earn real profits after you pass our trader assessment.

20 May 2025, 06:46 Gold Slips as Ceasefire Hopes Curb Safe-Haven Demand

7 May 2025, 03:59 Geopolitical Risks and FOMC Uncertainty Shake Global Markets

6 May 2025, 05:53 Dollar Dips, Gold Rallies on U.S.-Taiwan Risk

New Registrations Unavailable

We’re not accepting new registrations at the moment.

While new sign ups are unavailable, existing users can continue their challenges and trading activities as usual.