Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

11 June 2024,02:00

Trade Of The Day

Tags:

The Nasdaq has surged to fresh record highs, bolstered by bullish momentum stemming from the ongoing excitement around artificial intelligence (AI). This rally is particularly influenced by Apple’s recent announcement to enhance its Siri voice assistant and operating systems through a partnership with OpenAI’s ChatGPT. This strategic move aims to position Apple more competitively in the AI race. The upcoming updates to the iPhone and Mac operating systems, which will include access to ChatGPT, are set to launch in a test version this autumn.

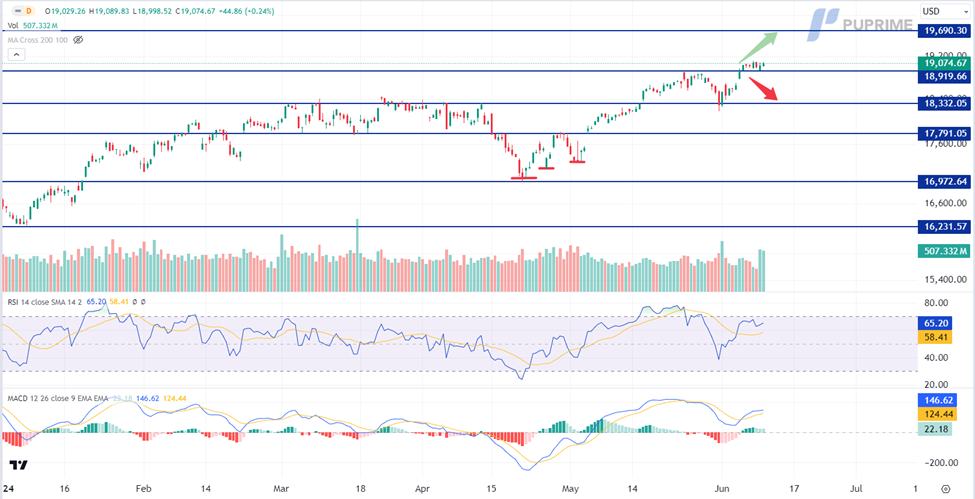

* Technical Breakout: The Nasdaq has successfully broken above a strong previous resistance level of 18,920.00. The recent AI hype suggests that there might be further room for gains, potentially extending towards the next resistance level at 19,690.00. The Relative Strength Index (RSI) continues to stay above the midline, indicating sustained bullish momentum.

Resistance Level: 19,690.00

Support Level: 18,920.00

Understand how technical analysis can help you in this trading opportunity.

Potential Risks: Investors should be cognizant of significant market volatility, particularly in the lead-up to the release of crucial US Consumer Price Index (CPI) data and the Federal Reserve’s interest rate decisions. These events are known to trigger substantial market movements and could pose risks to the current bullish trend.

Know how to manage trading risks with risk management strategies.

US CPI Data: Keep a close watch on the upcoming CPI data release, as it will provide insights into inflation trends and potential implications for monetary policy.

Federal Reserve Interest Rate Decisions: Monitor the Fed’s announcements and interest rate decisions, as these will directly impact market sentiment and future trading signals.

Stay updated by following PU Prime’s market insights and daily financial news.

Trade with simulated capital and earn real profits after you pass our trader assessment.

29 April 2025, 02:02 NASDAQ (NDX) Flat, Eye on Tech Earnings

28 April 2025, 05:30 HK50 Tests Resistance as China Unveils New Economic Support

25 April 2025, 06:45 Nasdaq Continues Uptrend as Tech Earnings Boost Market Sentiment

New Registrations Unavailable

We’re not accepting new registrations at the moment.

While new sign ups are unavailable, existing users can continue their challenges and trading activities as usual.