Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

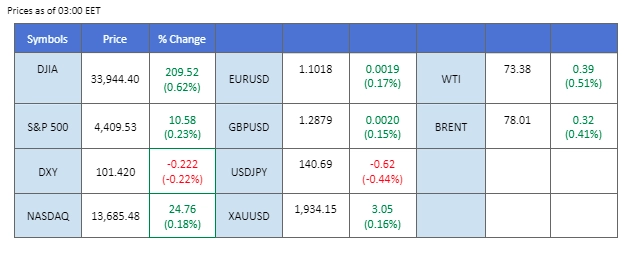

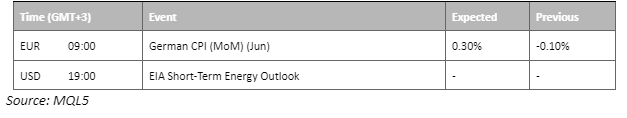

Several Federal Reserve officials have expressed the view that interest rates need to be raised further this year in order to bring inflation back to the targeted rate of 2%. Despite this hawkish sentiment from the Fed, the market is inclined to believe that the latest economic data suggests inflation in the U.S. is moderating, and the Fed is nearing the end of its monetary tightening cycle. As a result, the dollar’s value has been declining, along with U.S. treasury yields, while oil prices have received a boost from the expectation that the Fed will move away from the high-interest rate environment. In the meantime, investors eagerly anticipate the release of the U.S. Consumer Price Index (CPI) tomorrow (8th July) as a gauge of the Fed’s future monetary policy decisions.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (5%) VS 25 bps (95%)

The US Dollar experienced a sharp decline following comments from Federal Reserve officials, emphasising the need for additional interest rate hikes to address inflation while hinting at the approaching end of the current tightening cycle. Federal Reserve Vice Chair for Supervision, Michael Barr, suggested that although the conclusion was near, there was still work to be done.

The dollar index is trading while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 31, suggesting the index might enter oversold territory.

Resistance level: 102.50, 103.35

Support level: 101.95, 101.05

Gold prices remained stagnant around the crucial $1930 resistance level as investors awaited key economic data, particularly the Consumer Price Index (CPI) figures for June. Expectations of rising monthly price pressures have fueled concerns about inflation, increasing the likelihood of the Federal Reserve implementing interest rate hikes in their upcoming July monetary policy meeting. With a significant 92% of investors anticipating such a move, market volatility is expected, prompting cautious trading.

Gold prices are trading flat while currently near the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 56, suggesting the commodity might trade higher after it successfully breakout since the RSI stays above the midline.

Resistance level: 1930.00, 1950.00

Support level: 1910.00, 1895.00

The dollar further eased ahead of the U.S. CPI releases tomorrow while the pair has once again touched the 1.100 point since last May. Despite several Fed officials sounding hawkishly urging for higher interest rates to bring the inflation rate down to the central bank’s favour rate, the market is reacting accordingly with the economic data. The CPI has halved from its peak while the job data showed the labour market is easing, which led the market to believe the Fed’s monetary tightening cycle is nearing to end. Investors closely watch the CPI that will be released tomorrow to gauge the Fed’s next policy moves.

EUR/USD traded strongly and broke above its psychological resistance level at 1.100. The RSI continues to rise and is approaching the overbought zone while the MACD continues to diverge and both suggest the pair is trading in a bullish momentum.

Resistance level: 1.1027, 1.1088

Support level: 1.0951, 1.0892

Cable rose to its highest level since last April to 1.2879 as the dollar further eased the previous night despite Fed officials claiming that higher interest rates are needed to bring the inflation rate down to the targeted rate. However, the market is led by the NFP reading that was released last Friday, showing that the labour market has signs of moderating and will ease the pricing pressure in the U.S. Investors believe that the Fed is nearing to end its monetary tightening cycle and the CPI data release tomorrow will be vital for the market to gauge the Fed’s next moves. On the other hand, U.K. inflation has remained high and it is almost certain that the BoE will continue to raise interest rates to tame inflation.

The Cable is trading on a bullish momentum while it has traded to its highest since last April. The RSI constantly hovers near the overbought zone while the MACD moves upward after breaking above the zero line suggesting the bullish momentum is still strong.

Resistance level: 1.2900, 1.2998

Support level: 1.2775, 1.2700

The Dow Jones Industrial Average remained flat in anticipation of significant inflation data set to be released later this week. Heightened market volatilities, driven by the impending inflation figures and upcoming earning reports from major US banks, led investors to adopt a cautious approach and steer clear of riskier assets, including the US equity market. However, the Dow’s losses were mitigated by the backdrop of dovish remarks from Federal Reserve officials, which reinforced the notion that the central bank might be nearing the conclusion of its tightening cycle.

The Dow is trading flat while currently testing the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 48, suggesting the index might be traded higher in short-term as technical correction since the RSI rebound from oversold territory.

Resistance level: 34445.00, 34895.00

Support level: 33700.00, 33260.00

The New Zealand Dollar traded flat ahead of the highly anticipated interest rate decision by the Reserve Bank of New Zealand (RBNZ). Market participants widely expect the RBNZ to maintain its current interest rates this week, bringing an end to a streak of 12 consecutive rate hikes, as the economy cools and inflation shows signs of easing. All 18 economists surveyed by Bloomberg predict that the Official Cash Rate will remain unchanged at 5.5% during the RBNZ’s meeting in Wellington.

NZD/USD is trading flat while currently near the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 56, suggesting the pair might extend its gains after it successfully breakout since the RSI stays above the midline.

Resistance level: 0.6245, 0.6415

Support level: 0.6070, 0.5855

Oil prices experienced a slight dip as the economic progress of China, the largest oil importer, raised concerns. China’s consumer inflation rate remained flat in June, while factory-gate prices continued to decline, heightening worries about deflation risks. With producer prices witnessing a significant 5.4% year-on-year slump, the most substantial drop since December 2015, China’s potential deflationary environment dampened economic momentum and diminished market optimism regarding oil demand.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 59, suggesting the commodity might extend its losses since the RSI retraced sharply from overbought territory.

Resistance level: 74.90, 76.90

Support level: 72.60, 67.65

Trade with simulated capital and earn real profits after you pass our trader assessment.

20 May 2025, 06:46 Gold Slips as Ceasefire Hopes Curb Safe-Haven Demand

7 May 2025, 03:59 Geopolitical Risks and FOMC Uncertainty Shake Global Markets

6 May 2025, 05:53 Dollar Dips, Gold Rallies on U.S.-Taiwan Risk

New Registrations Unavailable

We’re not accepting new registrations at the moment.

While new sign ups are unavailable, existing users can continue their challenges and trading activities as usual.