Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

Join the PU Xtrader Challenge Today

Trade with simulated capital and earn real profits after you pass our trader assessment.

19 April 2023,06:03

Daily Market Analysis

The US Dollar continues to struggle as uncertainty over US monetary policy lingers in the global financial market. Despite hawkish comments from Atlanta Fed President Raphael Bostic and James Bullard regarding the need for rate hikes to combat inflation, market participants remain sceptical as the recent inflation data from the US region has shown signs of easing. As such, the future monetary policy plans of the Federal Reserve remain data-dependent, and investors are advised to monitor economic data for further signals closely. Meanwhile, major corporations in the US equity market have reported mixed quarterly financial results, with Goldman Sachs Group Inc underperforming and Bank of America exceeding expectations. On the other hand, faster-than-anticipated wage growth in the UK has fueled speculation among investors of higher rate hikes from the Bank of England in the next month, spurring bullish momentum on the Pound Sterling.

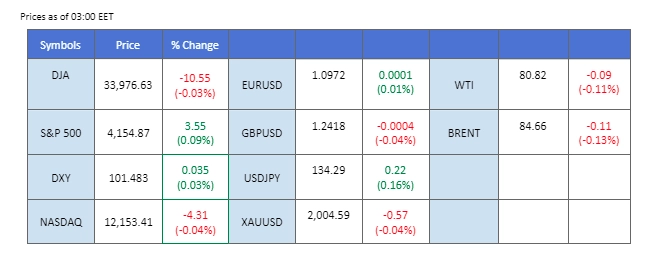

Current rate hike bets on 3rd May Fed interest rate decision:

Source: CME Fedwatch Tool

25 bps (18.6%) VS 50 bps (81.4%)

The dollar fell 0.37% to $101.702 amidst mixed sentiment from Fed officials. Atlanta Fed President Raphael Bostic preferred another rate hike to curb persistently high inflation but noted that banking system stresses were subsiding. He suggested that rates could remain at the 5% level for some time after the next hike, pending expected data. Meanwhile, James Bullard has expressed his hawkish view, saying he would like to see interest rates in a range of 5.5% to 5.75%. It contrasts with Bostic’s preference for a final rate hike followed by a prolonged hold above 5%. Both comments have triggered investor concerns about a potential recession.

The dollar is retreating to below $102 as mixed sentiment in the market. The MACD line is trading above the zero line, indicating neutral momentum. RSI is at 49, also showing a neutral momentum.

Resistance level: 102.00, 102.84

Support level: 101.45, 100.80

Gold prices rose 0.43% to $2005 on Tuesday amid concerns about recession fears from investors. Moreover, the dollar weakened, leading to gold prices going up. Investors turned to the safe-haven asset amid growing concerns of a potential recession. Atlanta Fed President Raphael Bostic’s preference for another rate hike to curb inflation tempered investor worries, but his comments on subsiding banking system stresses provided little relief. James Bullard’s hawkish view of interest rates in the 5.5% to 5.75% range added to investor anxiety. Investors are advised to wait for further earnings reports and comments from other Fed officials to gain more insight into the decision on the rate hike.

Gold prices crawl back above the $2000 level on Tuesday. However, MACD has illustrated diminishing bullish momentum ahead. RSI is at 47, indicating the pair hovers in the middle line due to the market’s lack of direction, trading in a neutral momentum.

Resistance level: 2030, 2053

Support level: 1987, 1949

The Euro surged in the wake of hawkish comments from the European Central Bank (ECB) regarding the state of the European economy. According to ECB Chief Economist, Philip Lane, the Euro area economy is unlikely to fall into a recession, thanks in part to the easing of some banking tensions and the gradual dissipation of negative supply shocks. Lane’s optimistic remarks have given investors renewed confidence in the region’s economic prospects, as the Euro continues to gain ground against other major currencies.

EUR/USD is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 51, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 1.1075, 1.1170

Support level: 1.0925, 1.0790

Investor risk appetite showed remarkable resilience in response to China’s release of better-than-forecast growth data, which caused a decline in the safe-haven US Dollar and fueled a surge in bullish momentum for Chinese proxy currencies like the Australian Dollar. The National Bureau of Statistics reported a significant jump in China’s Gross Domestic Product, rising from the previous reading of 2.90% to an impressive 4.5%, exceeding market expectations of 4.00%. This data underscores the continued resilience of the Chinese economic recovery following the easing of Covid-19 restrictions.

AUDUSD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 0.6730, 0.6785

Support level: 0.6635, 0.6580

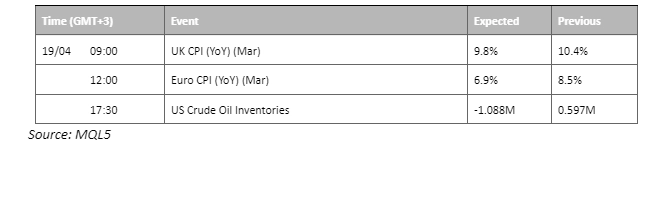

The British pound has risen by 0.27% to $1.2416 against the dollar, following news of faster-than-anticipated wage growth in the U.K. It has led economists to believe that the Bank of England may increase interest rates next month, despite an unexpected increase in joblessness. The rise in pay growth has outweighed the surprise increase in the unemployment rate in the three months to February, prompting optimism about the U.K. economy. In addition, investors await the U.K. CPI data, which is due later today.

MACD is trading below the zero line, indicating the pound has entered into neutral-bearish in the near term. RSI is at 47, suggesting a neutral-bearish momentum ahead. Investors are advised to exercise caution and closely monitor market developments to make the most informed decisions possible.

Resistance level: 1.2422,1.2542

Support level: 1.2261,1.2155

The Dow Jones Industrial Average has been trading in a flat trajectory in the aftermath of mixed quarterly results from major US banks. One notable underperformer was Goldman Sachs Group Inc, which saw its stock fall by over 1% after posting first-quarter revenue that missed analysts’ expectations. However, the Bank of America fared better, reporting a beat on both the top and bottom lines, driven by a 25% surge in net interest income following a rise in interest rates. Despite some positive earnings reports, mixed banking results from major US financial institutions have fueled further uncertainty regarding the overall outlook for the US economy.

The Dow is trading higher while currently near the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 65, suggesting the pair might be traded lower as technical correction since the RSI retreated sharply from the overbought territory.

Resistance level: 34265.00, 35770.00

Support level: 32650.00, 31435.00

As investors are concerned about a potential recession, oil prices dropped 1.94% to $80.86. As most companies report positive earnings, particularly in the banking sector, Wall Street is concerned about potential rate hikes from the Federal Reserve. This speculation affects the oil market, with crude oil prices being impacted. At the same time, Iraq and Kurdistan resuming northern oil exports have increased global oil supplies, putting downward pressure on crude oil prices.

As we can see, oil prices are gapping down nearly 2%, falling below the previous support level. In this case, we could expect the oil price might enter into bearish momentum. MACD remains in bullish momentum, but RSI is slumping to 40, indicating the pair is returning to bearish sentiment.

Resistance level: 81.64, 84.43

Support level: 79.08, 75.75

Trade with simulated capital and earn real profits after you pass our trader assessment.

20 May 2025, 06:46 Gold Slips as Ceasefire Hopes Curb Safe-Haven Demand

7 May 2025, 03:59 Geopolitical Risks and FOMC Uncertainty Shake Global Markets

6 May 2025, 05:53 Dollar Dips, Gold Rallies on U.S.-Taiwan Risk

New Registrations Unavailable

We’re not accepting new registrations at the moment.

While new sign ups are unavailable, existing users can continue their challenges and trading activities as usual.